|

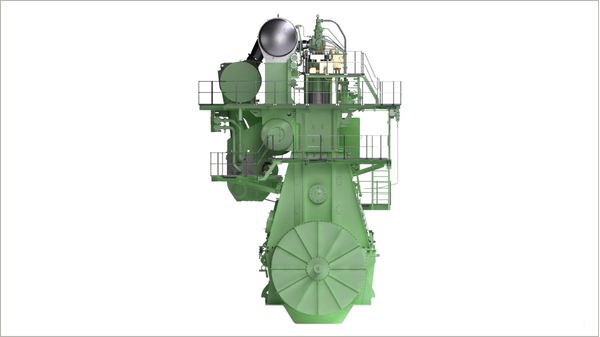

Everllence receives 2,000th dual-fuel engine order from Cosco

Chinese shipping line orders 12 methane-fuelled engines for new 18,000-teu container vessels. |

|

|

|

||

|

NYK signs long-term charter deals with Cheniere for new LNG carriers

Japanese shipping company partners with Ocean Yield for vessels to be delivered from 2028. |

|

|

|

||

|

Sallaum Lines takes delivery of LNG-powered container vessel MV Ocean Legacy

Shipping company receives new dual-fuel vessel from Chinese shipyard as part of fleet modernisation programme. |

|

|

|

||

|

Rotterdam bio-LNG bunkering surges sixfold as alternative marine fuels gain traction

Port handled 17,644 cbm of bio-LNG in 2025, while biomethanol volumes tripled year-on-year. |

|

|

|

||

|

TFG Marine calls for digital transformation to manage alternative fuel risks

CFO says transparency and digital solutions are essential as the marine fuels sector faces volatility from diversification. |

|

|

|

||

|

Reganosa’s Mugardos terminal adds bio-LNG bunkering for ships and trucks

Spanish facility obtains EU sustainability certification to supply renewable fuel with 92% lower emissions. |

|

|

|

||

|

Growth Energy joins Global Ethanol Association as new member

US biofuel trade association represents nearly 100 biorefineries and over half of US ethanol production. |

|

|

|

||

|

H2SITE explains decision to establish Bergen subsidiary

Ammonia-to-hydrogen technology firm says Norwegian city was obvious choice for its ambitions. |

|

|

|

||

|

Gibraltar Port Authority issues severe weather warning for gale-force winds and heavy rain

Port authority warns of storm-force gusts of up to 50 knots and rainfall totals reaching 120 mm. |

|

|

|

||

|

Christiania Energy relocates headquarters within Odense Harbour

Bunker firm moves to larger waterfront office to accommodate growing team and collaboration needs. |

|

|

|

||

| Neste marks 70th anniversary with 'passion for renewal' theme [News & Insights] |

| Neste completes Naantali revamp to slash heavy fuel oil production [News & Insights] |

| Naantali refinery in two-month revamp to slash heavy fuel oil production [News & Insights] |

| Neste's new high-viscosity 0.1% marine fuel unit set to reach 'high' utilization in H2 [News & Insights] |

| Neste sets out Baltic strategy following record year [News & Insights] |