|

ABB publishes 2025 maritime insights on decarbonization and digitalization

Technology firm compiles annual articles exploring energy efficiency, automation, and alternative fuels for the shipping industry. |

|

|

|

||

|

ClassNK grants approval for multi-fuel ready bulk carrier design by Oshima Shipbuilding

Vessel design accommodates future conversion to ammonia, methanol, or LNG with carbon capture capability. |

|

|

|

||

|

Four countries propose Arctic fuel measure to cut black carbon from shipping

Proposal to IMO's PPR 13 meeting aims to establish fuel regulations under MARPOL Annex VI. |

|

|

|

||

|

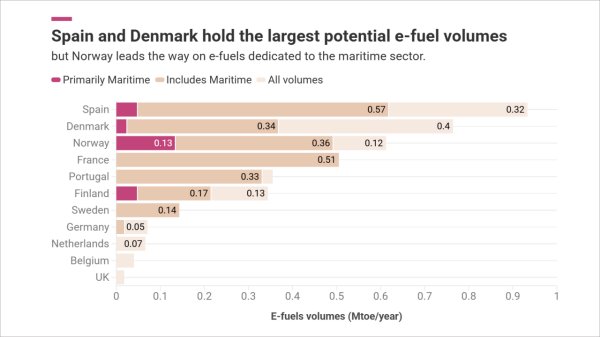

Spain, Norway and Denmark lead Europe's green shipping fuel production, study finds

Regulatory uncertainty prevents most e-fuel projects from progressing beyond the planning stage, says analysis. |

|

|

|

||

|

Dan-Bunkering appoints Charles Simon Edwin as operations and compliance manager in Singapore

Edwin transitions from sourcing role, bringing experience from physical supply operations and bunker trading. |

|

|

|

||

|

Hapag-Lloyd wins ZEMBA's second tender for e-methanol deployment

Container line to deploy e-methanol on trans-oceanic route from 2027, abating 120,000 tonnes CO₂e. |

|

|

|

||

|

RINA grants approval for Chinese nuclear-powered Arctic icebreaker design

CSSC's multi-role vessel combines cargo transport and polar tourism with molten salt reactor propulsion. |

|

|

|

||

|

Glander International Bunkering seeks two bunker traders for Singapore office

Firm recruiting traders with 3-5 years of experience to join team in key Asian hub. |

|

|

|

||

|

Malik Supply seeks bunker trader for Fredericia office

Danish company advertises role focusing on client portfolio development and energy product trading. |

|

|

|

||

|

Chimbusco Pan Nation seeks credit analysts for Asia-Pacific and Middle East expansion

Bunker firm recruiting for Hong Kong, Singapore, and Shanghai offices with APAC and MENA focus. |

|

|

|

||

| Scrubber technology for Finlandia Seaways [News & Insights] |

| DFDS chooses fuel-saving solutions [News & Insights] |

| DFDS orders exhaust gas cleaning systems [News & Insights] |

| DFDS crew save fuel with operational tweaks [News & Insights] |

| DFDS Tor Line invests in scrubber system [News & Insights] |