|

UK P&I Club joins SEA-LNG coalition to support LNG marine fuel adoption

Insurer brings 50 years of LNG experience to methane pathway coalition focused on maritime decarbonisation. |

|

|

|

||

|

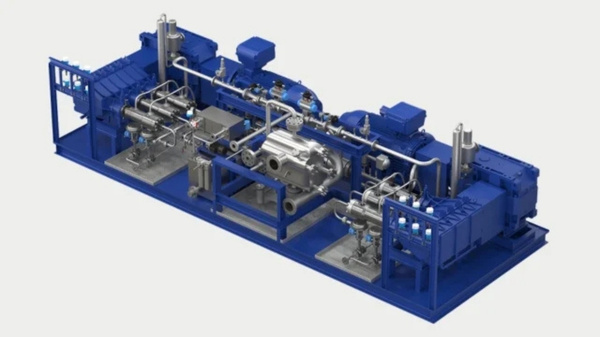

Alfa Laval launches LNG fuel supply system with cryogenic technology

Swedish firm unveils FCM LNG system for LNG-powered vessels, with marine deliveries planned for 2027. |

|

|

|

||

|

Union Maritime orders Anemoi rotor sails for two chemical tanker newbuilds

Wind propulsion technology to help shipowner exceed IMO 2030 greenhouse gas reduction targets. |

|

|

|

||

|

Lloyd's Register completes Europe's first major LNG cruise ship dry docks with Carnival

Iona and Mardi Gras projects required 18 months of planning and in-service passenger inspections. |

|

|

|

||

|

Anglo-Eastern completes pilot training course for ammonia-fuelled vessels

Ship manager prepares crew ahead of first ammonia-fuelled vessel takeover with inaugural training programme. |

|

|

|

||

|

Burando Atlantic publishes first sustainability report, secures ISCC EU recertification

Maritime group releases inaugural sustainability report while Burando Energies extends biofuel traceability certification. |

|

|

|

||

|

ABB and HDF Energy to develop high-power fuel cells for large ships

Joint development targets megawatt-scale hydrogen fuel cell units for container feeders and liquefied hydrogen carriers. |

|

|

|

||

|

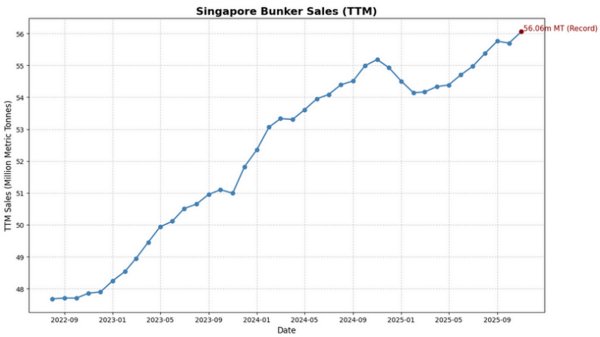

Singapore bunker sales break new ground as TTM volumes surpass 56m tonnes

Trailing 12-month bunker sales rise to new all-time record at Asian port. |

|

|

|

||

|

Odfjell launches operational green corridor between Brazil and Europe using biofuel

Chemical tanker operator establishes route using B24 sustainable biofuel without subsidies or government support. |

|

|

|

||

|

Somtrans christens 8,000-cbm LNG bunker barge for Belgian and Dutch ports

United LNG I designed for inland waterways and coastal operations up to Zeebrugge. |

|

|

|

||

| Andatee CEO buys 13,050 shares [News & Insights] |

| More shares for Andatee CEO [News & Insights] |

| Andatee Q3 net income jumps 74 percent [News & Insights] |

| Andatee approves share repurchase plan [News & Insights] |