|

By the end of October 2025, six months had passed since the implementation of the Mediterranean Emission Control Area (ECA). This article will set out to review what’s changed in terms of the fuel mix and fuel quality across the region between 1 November 2024 and 31 October 2025.

Pre-Mediterranean ECA

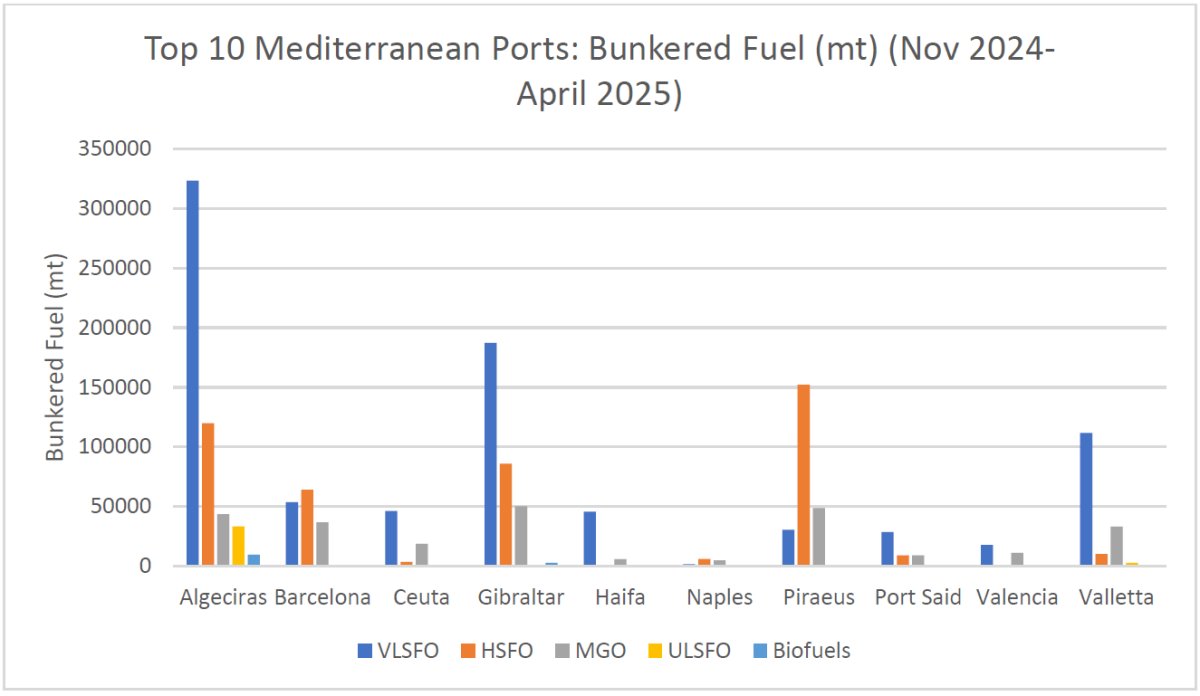

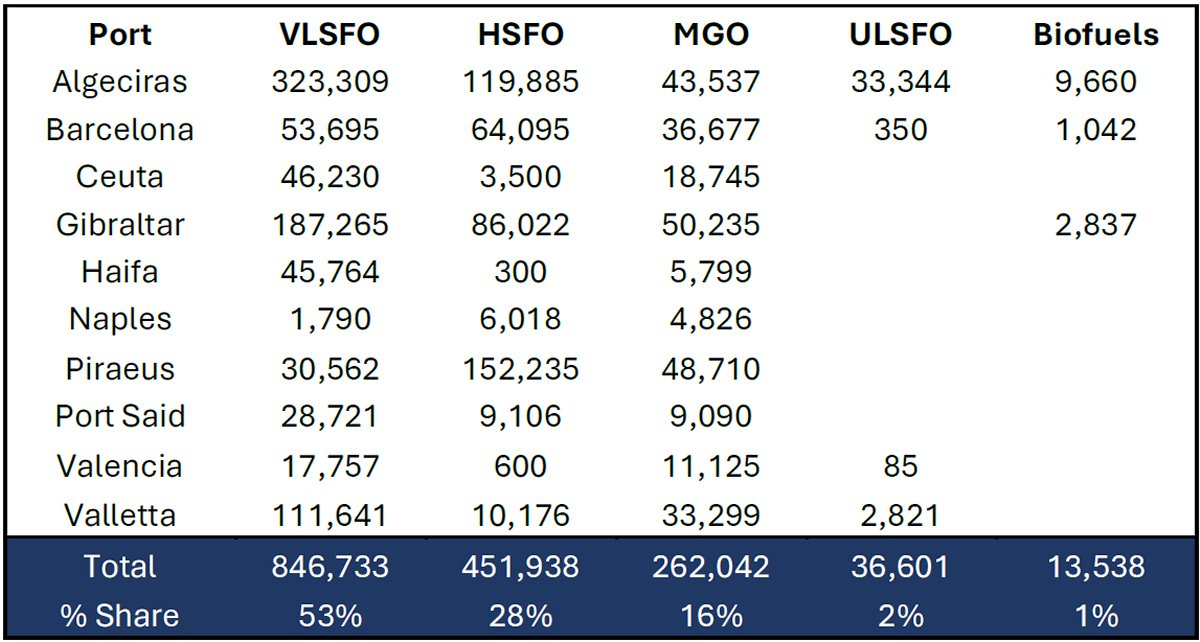

The six months leading up to the implementation of the Mediterranean ECA (1 November to 30 April 2025), VPS tested marine fuels representing 1,610,852 mt, bunkered in the Top 10 Mediterranean ports. This consisted of 53% VLSFO, 28% HSFO, 16% MGO, 2% ULSFO and 1% biofuels. These Top 10 Mediterranean ports during the six months leading up to the ECA coming into force provided approximately 90% of the total fuel tested by VPS from the whole region. The breakdown by port and fuel type in mt was as follows:

|

|

Over the six month period pre-ECA (Nov '24 to Apr '25), 5.5%, by volume, of all fuels bunkered across the Top 10 Mediterranean ports, were off-specification. However, by fuel type over that time period, the following off-specification rates were observed:

In terms of the off-specification parameters by fuel type pre-ECA, these were mainly the following:

Post-Mediterranean ECA

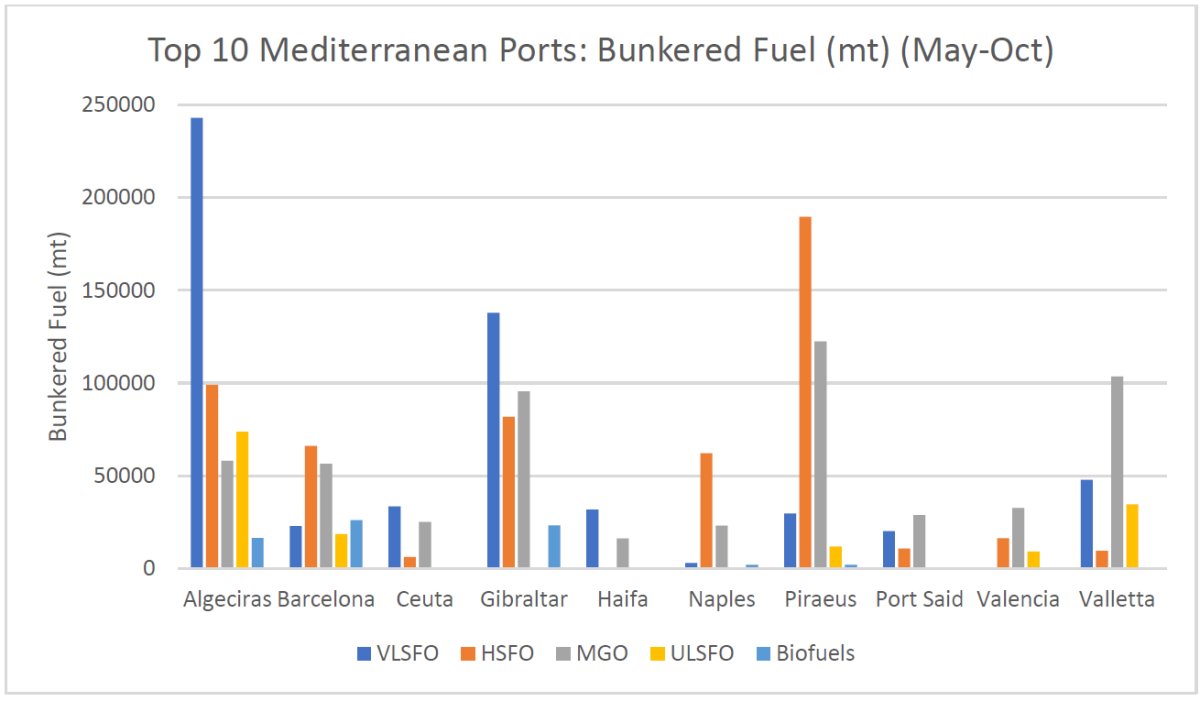

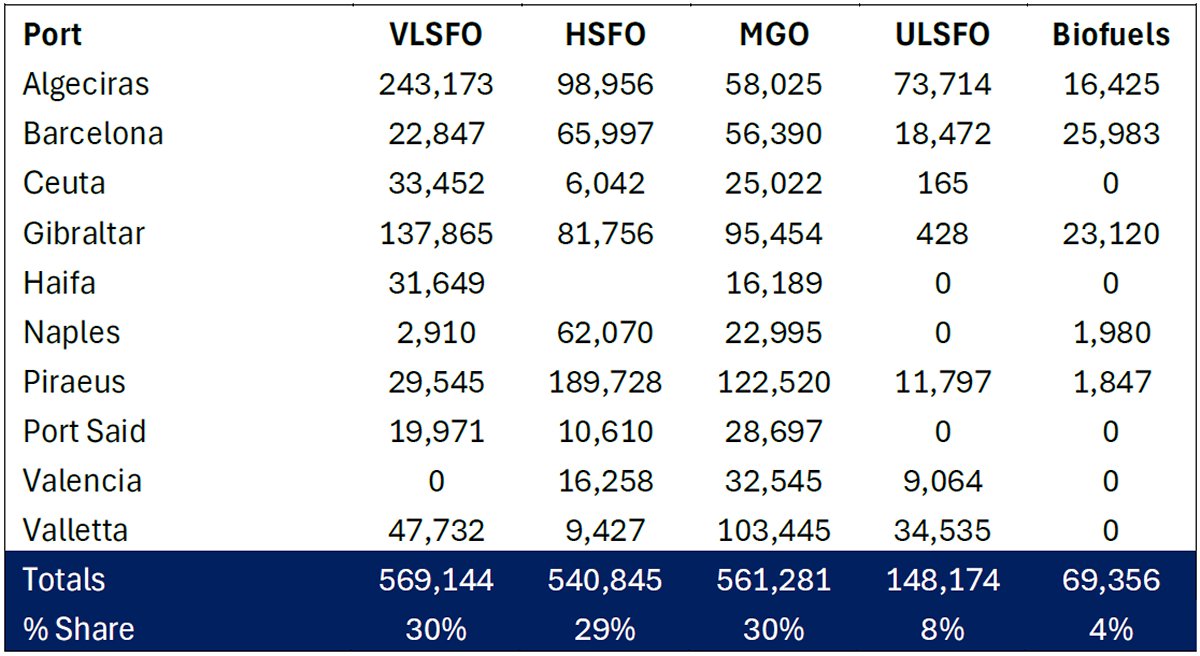

From the implementation of the Mediterranean ECA on 1 May until 31 October 2025, VPS tested marine fuels representing 1,888,799 mt from the Top 10 Mediterranean ports. This consisted of 30% VLSFO, 29% HSFO, 30% MGO, 8% ULSFO and 4% biofuels.

Looking at the Top 10 Mediterranean ports since the start of the ECA and up to 31 October, these ports have supplied approximately 90% of the total fuel tested by VPS, which is a similar percentage to the six-month period pre ECA.

The breakdown by port and fuel type in mt is as follows:

|

|

Impact of the Mediterranean ECA

The relative percentage volume of VLSFO bunkered in the ECA has decreased significantly since its implementation, whilst HSFO has increased slightly, with MGO, ULSFO and biofuel volumes all dramatically increasing in volumes.

However, looking at the actual volumes post-ECA versus pre-ECA, VLSFO has decreased by -278k mt, whilst HSFO (+89k mt), MGO (+300k mt), ULSFO (+112k mt) and biofuels (+56k mt), have all increased, indicating an increased mix in the use of compliant fuels (<0.1% sulphur) and scrubber usage across the Mediterranean ECA.

The combined off-specification rate for the Top 10 Mediterranean ports, across all fuels since the implementation of the ECA, is 5.1%, which is only slightly lower to the pre-ECA off specification rate of 5.5%. However, by fuel type over that time period, the following off specification rates were observed:

In terms of the off-specification parameters by fuel type post ECA, these were mainly the following:

The high level of ULSFO off-specifications, came from 78 bunker stems (29k mt) out of 341 delivered stems (148k mt):

Summary

As stated, this article compares bunker volumes and quality, six months pre-ECA versus the first six months post-ECA implementation.

Both before and after ECA implementation, the Top 10 Mediterranean ports provide 90% of all fuel within the region.

From these Top 10 Mediterranean ports, VPS tested marine fuels representing 1.9 million mt from the new ECA region compared with 1.6 million mt in the six months leading up to the ECA implementation, showing an almost 20% increase in fuel supply.

Pre-ECA implementation, the fuel mix in the Mediterranean was 53% VLSFO, 28% HSFO, 16% MGO, 2% ULSFO and 1% biofuels. From 1 May 2025, the mix changed to, 30% VLSFO, 29% HSFO, 30% MGO, 8% ULSFO and 4% biofuels.

So, in terms of actual tonnage, VLSFO decreased by 23%, whilst MGO usage increased by 107%. ULSFO supply increased 4-fold and biofuels increased 5-fold.

Overall off-specification rates for all fuels before ECA implementation was 5.5% and over the first six month since the start of the ECA, the rate was 5.1%. Since the ECA implementation, off specification rates for VLSFO and HSFO have reduced to 5% and 3%, respectively. However, MGO off-specification rates have increased to 4%. But the most worrying off specification rates are for ULSFO which have shown a tenfold increase from 2% to 20% since the start of the ECA, with the main off-specification parameters for ULSFO being pour point, sulphur, TSP, CCAI, water and viscosity.

So in conclusion, as anticipated, the implementation of the Mediterranean ECA on 1 May 2025 has seen a significant change in the Mediterranean fuel mix, with a significant reduction in VLSFO supply and demand, but a major increase in the supply and demand of MGO, ULSFO and biofuels. A 20% increase in HSFO supply would indicate an increase in scrubber-fitted vessels and/or existing scrubber-fitted vessels taking more HSFO fuel.

The wide range of off-specifications across the fuel mix continues to highlight the need for proactive fuel testing to protect the vessel, their crew and the environment. The ultimate outcome being a successful reduction in SOx, NOx, PM and GHG emissions across the Mediterranean Sea.

By Steve Bee, VPS Group Marketing & Strategic Projects Director

|

Petrobras and Transpetro order 41 vessels worth $470m for fleet renewal

Brazilian state oil companies contract gas carriers, barges and pushboats from domestic shipyards. |

|

|

|

||

|

EU proposes phase-out of high-risk biofuels from renewable energy targets by 2030

Draft regulation sets linear reduction trajectory starting in 2024, with contribution reaching zero by end of decade. |

|

|

|

||

|

H2SITE launches Norwegian subsidiary to advance ammonia-to-power technology for maritime sector

Spanish technology firm establishes Bergen hub to accelerate deployment of ammonia cracking systems for shipping. |

|

|

|

||

|

CMA CGM names 400th owned vessel as methanol-fuelled containership

French shipping line reaches fleet ownership milestone with 15,000-teu dual-fuel methanol vessel. |

|

|

|

||

|

Wah Kwong adds China’s first dual-fuel methanol bunkering vessel to managed fleet

Da Qing 268 completed maiden operation at Shenzhen’s Yantian Port on 21 January. |

|

|

|

||

|

Sumitomo SHI FW licenses VTT syngas technology for sustainable fuels plants

Agreement enables production of green methanol and SAF from biowaste for global gasification projects. |

|

|

|

||

|

Yinson GreenTech launches upgraded electric cargo vessel in Singapore, expands to UAE

Hydromover 2.0 offers increased energy storage capacity and can be fully recharged in under two hours, says designer. |

|

|

|

||

|

Island Oil appoints Nildeep Dholakia as senior trader in Dubai

Marine fuel supplier expands Dubai team as part of regional growth strategy. |

|

|

|

||

|

Dalian Shipbuilding's wind-assisted LNG carrier design receives Bureau Veritas approval

Design combines dual-fuel propulsion with foldable wing sails to cut emissions by 2,900 tonnes annually. |

|

|

|

||

|

Anglo-Eastern adds two methanol-ready Suezmax tankers to managed fleet

GH Angelou and GH Christie were christened at HD Hyundai Samho Shipyard on 5 January. |

|

|

|

||