|

BIMCO and Norwegian Shipbrokers’ Association launch SALEFORM 2025 ship sale contract

Updated agreement addresses banking changes, compliance requirements and environmental regulations affecting vessel transactions. |

|

|

|

||

|

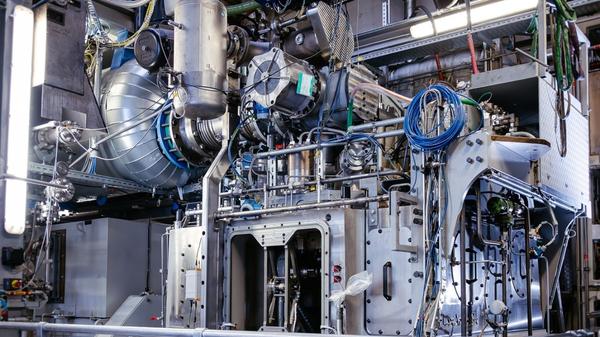

Everllence develops hydrogen test bench for marine engines

German engine maker upgrades Augsburg facility under HydroPoLEn project backed by federal maritime research funding. |

|

|

|

||

|

CMA CGM names 13,000-teu methanol-fuelled containership in South Korea

CMA CGM Osmium to operate on Asia–Mexico service as part of the carrier’s decarbonisation strategy. |

|

|

|

||

|

NorthStandard publishes biofuel guide as marine insurance claims emerge

White paper addresses quality issues and compliance requirements as biofuel testing volumes surge twelvefold. |

|

|

|

||

|

Maritime fuel platform calls for EU shipping ETS revenues to fund clean fuel deployment

Clean Maritime Fuels Platform urges earmarking of national emissions trading revenues for renewable fuel infrastructure. |

|

|

|

||

|

Lloyd’s Register grants approval for hybrid nuclear power design for amphibious vessels

Classification society approves Seatransport’s concept integrating micro modular reactors with diesel-electric systems. |

|

|

|

||

|

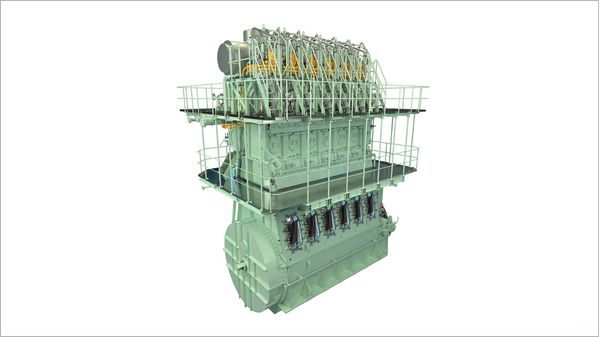

Everllence and Vale partner on ethanol-powered marine engine development

Brazilian mining company to develop dual-fuel ethanol engines based on ME-LGI platform. |

|

|

|

||

|

Emvolon highlights biomethanol as a solution to unlock India’s biogas potential

Company says distributed biogas-to-biomethanol production could bridge rural feedstock with maritime fuel demand. |

|

|

|

||

|

Grimaldi's Grande Svezia makes inaugural Le Havre call with ammonia-ready design

Second of 10 new-generation PCTCs features 5 MWh battery system and cold ironing capability. |

|

|

|

||

|

Kongsberg Maritime to supply integrated systems for LS Marine Solution cable lay vessel

Norwegian technology provider wins contract for ultra-large vessel being built at Tersan Shipyard in Türkiye. |

|

|

|

||

| Legal firm files lawsuit against Britannia Bulk [News & Insights] |

| NYSE suspends trading in Britannia Bulk [News & Insights] |

| OW Bunker appoints risk manager [News & Insights] |