Press Release: Source - BIMCO (the Baltic and International Maritime Council)

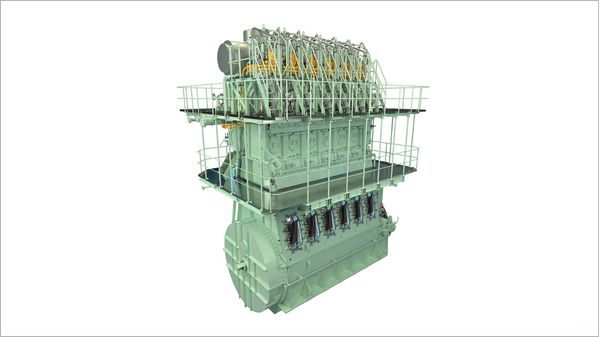

The drive for the use of LNG as a marine fuel is gaining ground. The initiative was launched by Norway a decade ago and is now being taken up by its Northern European neighbours. Meanwhile, other parts of the world are monitoring what is happening in Europe and assessing the ability of their gas supply chains to deliver the volumes of LNG required for vessel bunkering to the right place at the right time.

The use of LNG as marine fuel as yet is quite modest. Some 25 small vessels in Norwegian coastal service have LNG fuel systems and a new oil bunker barge for Rotterdam has been built to run on LNG.

This fleet will be augmented by another 25 such ships which are under construction. Again, most of the newbuildings will be small vessels flying the Norwegian flag, but several of the orders are for larger ships that will serve on international routes.

One of the non-Norwegian ships will be a 57,000 gross ton passenger car ferry that will sail between Finland and Sweden, burning 23,000 tonnes of LNG per annum in the process, when it goes into service in early 2013. This will be the largest ship in the world that is not an LNG carrier to run on LNG.

Other non-Norwegian, LNG-fuelled vessels on order include a high-speed catamaran ferry being built in Australia for service in Uruguay and a pair of offshore support vessels (OSVs) that will be built in the US to serve the needs of oil platforms in the US Gulf.

The OSVs mark a breakthrough in the use of LNG as marine fuel in North America. No doubt the fact that the coastal waters of the US and Canada are to become a sulphur emission control area (SECA) from August this year was a factor in the choice of fuel system.

Commercial considerations are just as important to the choice of propulsion system arrangements as the tightening IMO regulatory regime governing ship emissions. As time goes by and the price of oil fuel creeps up, the attractions of the LNG alternative are growing.

Taking North America as an example, the US and Canada are replete with very competitively priced gas as a result of its recent discoveries of shale and other unconventional gas. Powering North American fleets of OSVs, regional ferries, fishing boats, Great Lakers and inland waterway vessels with gas makes eminent good sense from a commercial point of view.

It is impossible to determine with any accuracy what the size of the global LNG marine fuel market will be in 2020. That is because it is not possible to say how many ship owners will favour LNG over the exhaust gas scrubber and low-sulphur middle distillate fuel alternatives as a means of meeting the stricter emissions controls coming into force over the next decade. Each option has its advantages in particular ship operating scenarios.

However, the growing disparity between gas and oil prices means that LNG is seen in an increasingly favourable light in assessments of the life cycle costs of the various options available. This commercial factor in tandem with the North and Baltic Sea SECAs are exerting a shift towards the LNG camp in Europe. Recent research commissioned by the Danish Maritime Authority concluded that gas-fuelled vessels operating in Northern Europe could be consuming up to 4 million tonnes per annum (mta) of LNG in their engines by 2020.

The European market for LNG as marine fuel will not reach such a level without the presence of an adequate bunkering network. It is estimated that an LNG marine fuel market of 4 mta would require at least 11 shore-side LNG bunkering stations positioned strategically around key North and Baltic Sea ports.

Before the recent uptick in the choice of the LNG fuel option outside Norway, ship owners and bunker suppliers considering this potential market had been caught up in a classic chicken-and-egg dilemma. Potential investors in port LNG bunkering infrastructure were reluctant to make a commitment due to uncertainties over how many LNG-powered vessels would be built. For their part, ship owners needed to be assured of adequate bunker supply infrastructure before ordering an LNG-powered vessel.

Momentum is now building to the extent that this conundrum should soon be a thing of the past. New LNG-fuelled ships continue to be ordered and the network of LNG fuelling stations in Northern Europe is about to blossom. The ordering of the first dedicated LNG bunker vessel must be imminent and in recent weeks a plan to provide Hamburg with a barge-mounted, LNG-fuelled power plant, to service cruise ships while berthed in the port, was unveiled.

Bunker suppliers seeking to provide ship operators with the required levels of LNG fuel will be able to source LNG from large import terminals, such as those at Zeebrugge and Rotterdam. These volumes will be delivered to the ships by coastal LNG carriers via either their local fuelling depot or by means of direct transfers to purpose-built bunker barges.

As this LNG fuelling network begins to take shape it is important that both the LNG shipping and general maritime industries take due account of the practical challenges posed by the day-to-day operation of such an infrastructure.

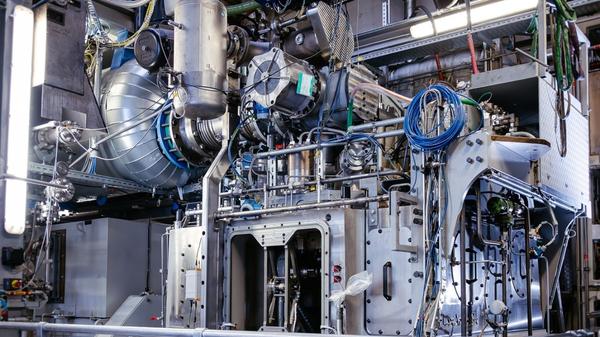

While gas-burning engines and shipboard LNG fuel systems are developed technologies, the use of LNG as a marine fuel poses operational as well as logistics challenges. Outside the LNG shipping sector, the general maritime industry is not familiar with handling this boiling cryogenic liquid.

How to get this new fuel, at -162I0;C, from the storage tank at the coastal terminal into the ship's LNG bunker tank? And who will be responsible for the LNG bunkering and fuelling operations on the ship? Although the introduction of LNG-fuelled ships will require some modification of the seafarer training regime, at this stage it has not yet been decided whether ships' engineering staff will need to undergo the same LNG familiarisation programmes as officers on LNG carriers.

Training is one of the issues that the IMO working and correspondence groups responsible for developing the new International Code on Safety for Gas-Fuelled Ships (IGF Code) currently have in focus.

Other LNG-related issues that seagoing staff with future involvement in LNG bunkering operations will need to be aware of are bunker tank conditioning; custody transfer arrangements to quantify the amount of fuel transferred; bunker fuel quality monitoring; boiloff gas management and the effects of differences in pressure and temperature during transfer.

These are remarkable and changing times for marine bunkering. What is inevitable is that ship fuelling and propulsion systems will be subject to major change. What is likely is that LNG fuel will have a major role to play over the coming decade and that Europe will be leading the way with these developments.