Emulsion fuel developer

Quadrise Fuels International Plc. (QFI) has said that it plans to begin the commercial supply of its emulsion marine fuel before the end of next year.

The news was revealed by QFI in its annual report, where the company posted a consolidated after-tax loss for the year to 30 June 2010 of GBP 3.9million (approximately USD 6.0 million). The figure represents an GBP 8.9 million (USD 13.9 million) decrease in net income from the GBP 5.0 million profit achieved the previous year.

The results included a charge of GBP 2.8 million (2009: £4.5 million) for the amortisation and impairment of intangible assets, administration expenses of GBP 1.2 million (2009: GBP 3.2 million) and bank deposit interest income of £0.05 million (2009: £0.05 million).

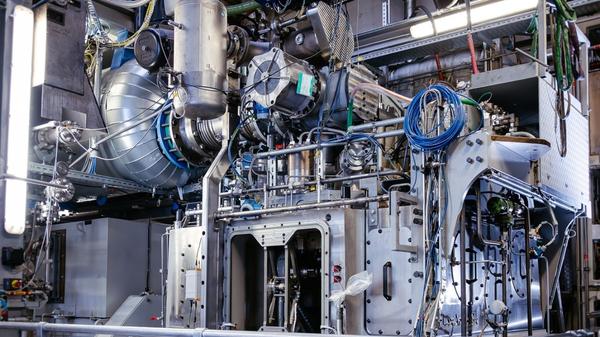

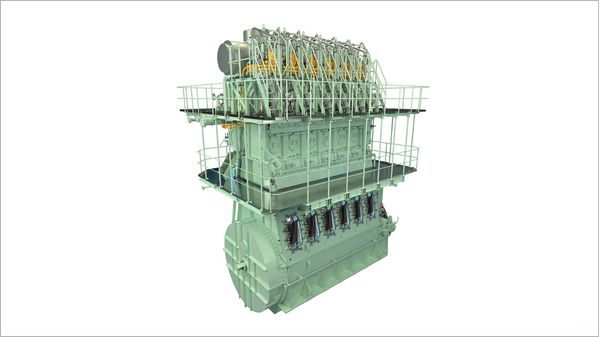

UK-based QFI produces an oil-in-water emulsion fuel, MSAR® (Multiphase Superfine Atomised Residue), as a low cost substitute for conventional heavy fuel oil (HFO) for use in industrial and marine diesel engines and in power generation plants.

The technology utilises the least valuable elements of the oil barrel resulting in a fuel that is said to be lower in cost than HFO and competitive with natural gas.

MSAR is also said to have superior combustion characteristics to conventional heavy fuel oil, achieving complete carbon burn-out and producing lower NOx emissions.

In March 2010 WFI signed an agreement with Danish shipping group

Maersk to jointly develop a marine version of QFI's MSAR emulsion fuel. Please find below the company's summary of the progress made so far.

Maersk Joint Development Agreement (JDA)

The comments below were provided by QFI Chairman

Ian Williams in a business review of the 12 month period to 30 June 2010.

"Arguably the most important breakthrough in late 2009 was the confirmation by Maersk of their potential interest in the joint development of a suitable emulsion fuel for substitution of fuel oil in marine engine application. The international marine bunker market is one of the largest global fuel oil markets and is facing serious challenges related to compliance with new progressive emissions standards.

"From 2020 new standards can only be met if the fuel oil sulphur content can be dramatically reduced, or if the ship owners can afford the additional cost of on-board emissions scrubbing. The practical and economic feasibility of adaptation by the oil refining industry to production of the large volumes of very low sulphur fuel oil or distillates required for this major market is in doubt. The associated cost will have major implications for refining process economics and related oil product costs and prices.

"Following discussions with QFI and AkzoNobel, Maersk came to understand that MSAR® marine fuels could contribute to a solution by offering a lower cost MSAR® emulsion fuel suitable for marine application. Refiners could supply the heavy residues from existing plants without expensive reconfiguration, and the MSAR® process could produce a “fit for purpose” marine emulsion fuel. By passing on a portion of the Quadrise related value add to the ship operator, the fuel cost saving would in the future make a major contribution to the cost of on-board emissions scrubbing and enable “affordable compliance”.

"Having satisfied themselves that the QFI proposition held substantial promise, Maersk entered into a JDA with the Company during the first quarter of 2010. The JDA defines a programme intended to satisfy all stakeholders that MSAR® marine fuels can meet all technical requirements for marine fuel application. The programme will also confirm that it is feasible to arrange supply to international vessel operators in major bunkering hubs – initially on key routes but eventually on a global basis.

"The programme defined in the JDA has progressed on time and on budget. The key technical challenge is to meet consistently a specification which will allow the ship operator to switch from bunker fuel oil to MSAR® fuel, without any modifications to onboard fuel preparation and combustion systems. The only requirement would be segregated fuel storage which in itself is becoming a mandatory feature of shipping operations to meet compliance in different regions. The technical aspects of the fuel development programme have been fully supported by AkzoNobel using their extensive know-how base, research facilities and expertise.

"The programme to date has passed all key development milestones. Participation has been extended to marine engine manufacturers, selected oil refiners, operators of fuel testing facilities and classification societies. The improvements achieved in formulation and quality standards have exceeded expectations and are testimony to the quality and commitment of the programme partners.

"The land based fuel evaluation and qualification process should be complete by December 2010 and a commercial scale proving sea trial is planned for the first quarter of 2011. The agreement provides that on success this will move forward to a commercial phase for the supply of MSAR® marine fuel, initially to the Maersk shipping fleet. Revenues from this sector are anticipated before December 2011.

Commenting on the significance of the marine fuels market in the company's overall business model, Williams said: "The marine fuels market is now expected to form a major component of the company’s future business mix. Growth in this very large global fuel oil market is expected to follow the recovery of international trade and commodity movements."