|

Ammonia emerges as most feasible alternative fuel for deep-sea shipping in 2050 emissions study

Research combining expert survey and technical analysis ranks ammonia ahead of hydrogen and methanol. |

|

|

|

||

|

EMSA study examines biodiesel blend spill response as shipping adopts alternative fuels

Research addresses knowledge gaps on biodiesel-conventional fuel blends as marine pollutants and response measures. |

|

|

|

||

|

BIMCO adopts ETS clause for bareboat charters, delays biofuel provision

BIMCO’s Documentary Committee has approved an emissions trading compliance clause while requesting further work on a biofuel charter provision. |

|

|

|

||

|

BIMCO and Norwegian Shipbrokers’ Association launch SALEFORM 2025 ship sale contract

Updated agreement addresses banking changes, compliance requirements and environmental regulations affecting vessel transactions. |

|

|

|

||

|

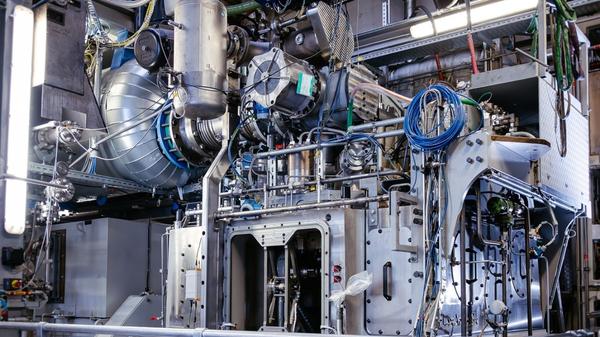

Everllence develops hydrogen test bench for marine engines

German engine maker upgrades Augsburg facility under HydroPoLEn project backed by federal maritime research funding. |

|

|

|

||

|

CMA CGM names 13,000-teu methanol-fuelled containership in South Korea

CMA CGM Osmium to operate on Asia–Mexico service as part of the carrier’s decarbonisation strategy. |

|

|

|

||

|

NorthStandard publishes biofuel guide as marine insurance claims emerge

White paper addresses quality issues and compliance requirements as biofuel testing volumes surge twelvefold. |

|

|

|

||

|

Maritime fuel platform calls for EU shipping ETS revenues to fund clean fuel deployment

Clean Maritime Fuels Platform urges earmarking of national emissions trading revenues for renewable fuel infrastructure. |

|

|

|

||

|

Lloyd’s Register grants approval for hybrid nuclear power design for amphibious vessels

Classification society approves Seatransport’s concept integrating micro modular reactors with diesel-electric systems. |

|

|

|

||

|

Everllence and Vale partner on ethanol-powered marine engine development

Brazilian mining company to develop dual-fuel ethanol engines based on ME-LGI platform. |

|

|

|

||

| Carnival 'well on its way' to meeting GHG reduction target [News & Insights] |

| Carnival bunker costs down $36 million in Q1 [News & Insights] |

| Carnival bunker costs fall $173 million [News & Insights] |

| Carnival recognized for its commitment to clean technology [News & Insights] |