|

Tallink Group moves towards 100% renewable fuel on Helsinki–Tallinn route

Megastar and MyStar ferries to run entirely on liquefied biomethane supplied by Elenger. |

|

|

|

||

|

Petronor’s synthetic fuel plant at the port of Bilbao to begin operations in 2027

Repsol-owned refiner expects annual production capacity of 2,000 tonnes from €146m facility using captured CO2. |

|

|

|

||

|

Fratelli Cosulich lays keel for third methanol-ready bunker tanker in China

Carlotta Cosulich is part of a four-vessel series designed to support the alternative marine fuels transition. |

|

|

|

||

|

Kongsberg Maritime to design and equip four methanol-ready tankers for Transpetro

Norwegian firm wins NOK 300m contract for Brazilian-built vessels through Consórcio MareNova partnership. |

|

|

|

||

|

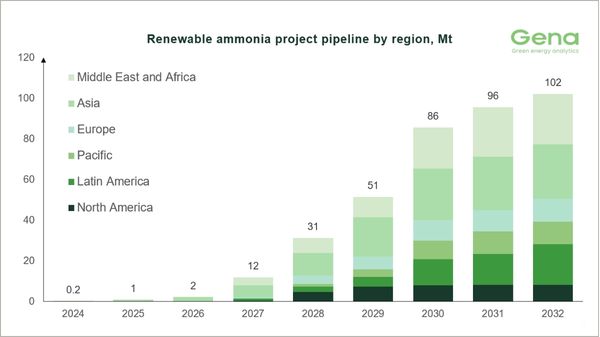

Clean ammonia project pipeline shrinks as offtake agreements remain scarce

Renewable ammonia pipeline falls 0.9 Mt while only 3% of projects secure binding supply deals. |

|

|

|

||

|

Thoen Bio Energy joins Global Ethanol Association

Shipping group with Brazilian ethanol ties becomes member as association plans export-focused project group. |

|

|

|

||

|

Norway enforces zero-emission rules for cruise ships in World Heritage fjords

Passenger vessels under 10,000 GT must use zero-emission fuels in Geirangerfjord and Nærøyfjord from January 2026. |

|

|

|

||

|

Longitude unveils compact PSV design targeting cost efficiency

Design consultancy launches D-Flex vessel as a cost-efficient alternative to larger platform supply vessels. |

|

|

|

||

|

IBIA seeks advisor for technical, regulatory and training role

Remote position will support the association’s IMO and EU engagement and member training activities. |

|

|

|

||

|

Barents NaturGass begins LNG bunkering operations for Havila Kystruten in Hammerfest

Norwegian supplier completes first truck-to-ship operation using newly approved two-truck simultaneous bunkering design. |

|

|

|

||

| Brittany Ferries secures financing for LNG-fuelled ferry newbuild [News & Insights] |

| Peninsula Petroleum secures additional bank funding [News & Insights] |

| SEA\LNG calls for compliance and enforcement commitment as 2020 sulphur cap looms [News & Insights] |

| LNG bunker coalition confirms addition of three members [News & Insights] |

| Novatek 'ready to facilitate the LNG bunkering market' as it joins SGMF and SEA\LNG [News & Insights] |