|

HMM deploys Korea's first MR tanker with wing sail technology

Oriental Aquamarine equipped with wind-assisted propulsion system expected to cut fuel consumption by up to 20%. |

|

|

|

||

|

ABB to supply hybrid-electric propulsion for BC Ferries' four new vessels

Technology will enable ferries to run on biofuel or renewable diesel with battery storage. |

|

|

|

||

|

LNG-fuelled boxships sustain alternative fuel orderbook share despite market slowdown

Alternative fuels maintained 38% of gross tonnage orders in 2025, driven by container segment. |

|

|

|

||

|

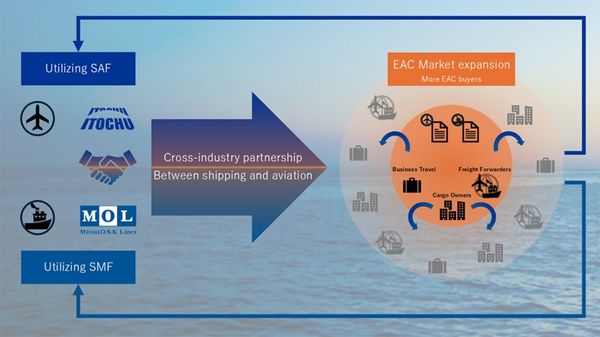

MOL and ITOCHU sign MoU for cross-industry environmental attribute certificate partnership

Japanese shipping and trading firms to promote EACs for reducing Scope 3 emissions in transport. |

|

|

|

||

|

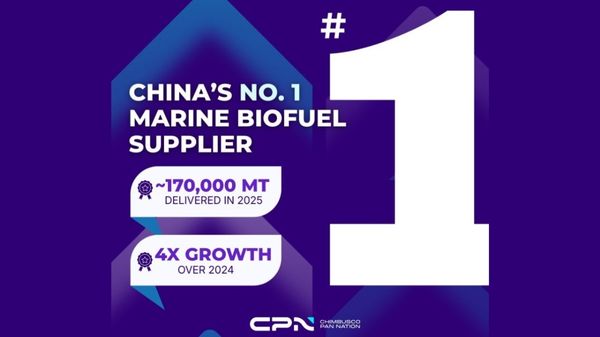

Chimbusco Pan Nation delivers 170,000 tonnes of marine biofuel in China in 2025

Supplier says volumes quadrupled year on year, with a 6,300-tonne B24 operation completed during the period. |

|

|

|

||

|

V.Group acquires Njord to expand decarbonisation services for shipowners

Maritime services provider buys Maersk Tankers-founded green technology business to offer integrated fuel-efficiency solutions. |

|

|

|

||

|

Has Zhoushan just become the world's third-largest bunker port?

With 2025 sales of 8.03m tonnes for the Chinese port, Q4 data for Antwerp-Bruges will decide which location takes third place. |

|

|

|

||

|

Monjasa opens applications for global trainee programme

Marine fuel supplier seeks candidates for MOST scheme spanning offices from Singapore to New York. |

|

|

|

||

|

Singapore's first fully electric tug completes commissioning ahead of April deployment

PaxOcean and ABB’s 50-tonne bollard-pull vessel represents an early step in harbour craft electrification. |

|

|

|

||

|

Lloyd's Register report examines hydrogen's potential and challenges for decarbonisation

Classification society highlights fuel's promise alongside safety, infrastructure, and cost barriers limiting maritime adoption. |

|

|

|

||

| Global Risk Management posts record earnings in 2016-17 [News & Insights] |