|

Corvus Energy raises $60m from consortium for maritime battery expansion

Norwegian energy storage supplier secures growth capital to accelerate zero-emission shipping solutions. |

|

|

|

||

|

Shipping industry warned nuclear power is essential to meet 2050 net zero targets

Experts say government backing is needed for nuclear investment. |

|

|

|

||

|

ExxonMobil enters LNG bunkering with two vessels planned for 2027

Energy company to charter vessels from Avenir LNG and Evalend Shipping for marine fuel operations. |

|

|

|

||

|

Shipping associations back IMO Net-Zero Framework ahead of key vote

Seven international associations urge governments to adopt comprehensive decarbonisation rules at IMO meeting. |

|

|

|

||

|

Study claims biofuels emit 16% more CO2 than fossil fuels they replace

Transport & Environment report challenges biofuels as climate solution ahead of COP30. |

|

|

|

||

|

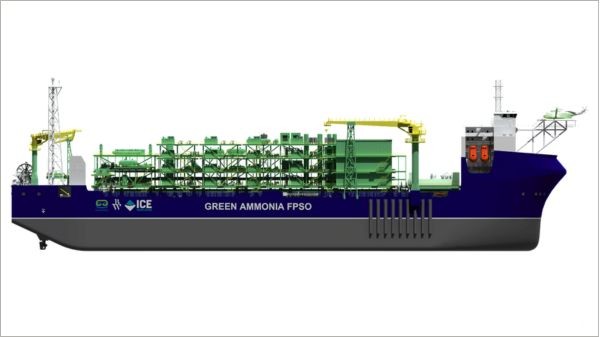

ABB to supply automation systems for floating green ammonia production vessel

Technology firm signs agreement with SwitcH2 for Portuguese offshore facility producing 243,000 tonnes annually. |

|

|

|

||

|

VPS launches Verisphere digital platform to streamline marine fuel decarbonisation tools

New ecosystem connects multiple maritime emissions solutions through single user interface. |

|

|

|

||

|

Wallenius Sol joins Gasum's FuelEU Maritime compliance pool as bio-LNG generator

Partnership aims to help shipping companies meet EU carbon intensity requirements through bio-LNG pooling. |

|

|

|

||

|

IAPH launches products portal with ammonia bunker safety checklist

Port association releases industry-first ammonia fuel checklist alongside updated tools for alternative marine fuels. |

|

|

|

||

|

Berkel AHK joins Global Ethanol Association as founding member

German ethanol producer becomes founding member of industry association focused on marine fuel applications. |

|

|

|

||

| K-Sea announces public offering [News & Insights] |

| Low emission tug wins Clean Air Technology Award [News & Insights] |