|

Spain nears completion of standardised LNG bunkering specifications framework

Document aims to harmonise LNG and bioLNG supply procedures across Spanish port authorities. |

|

|

|

||

|

Synergy Marine Group takes technical management of two Yang Ming LNG dual-fuel newbuilds

Singapore-based ship manager assumes responsibility for 15,500-teu container vessels delivered from Hyundai Heavy Industries. |

|

|

|

||

|

Austal begins construction of hydrogen-ready ferry for Swedish operator

Shipbuilder cuts first steel for 130-metre Horizon X vessel at Philippines facility. |

|

|

|

||

|

UK's first commercial biomethanol bunkering service launches at Immingham

Exolum, Methanex and Ørsted partner to supply biomethanol for shipping at the UK's largest port by tonnage. |

|

|

|

||

|

Vitol Bunkers launches HSFO supply in Pakistan after four-year hiatus

Company resumes high-sulphur fuel oil bunkering at three Pakistani ports following earlier VLSFO and LSMGO launches. |

|

|

|

||

|

CIMC SOE secures orders for three LNG bunkering vessels

Chinese shipbuilder adds two 20,000 cbm and one 18,900 cbm LNG bunkering vessels to order book. |

|

|

|

||

|

Lehmann Marine to supply battery systems for Hamburg’s first electric ferries

German firm wins contract for three 3.8 MWh systems for HADAG vessels entering service in 2028. |

|

|

|

||

|

Viking Line green corridor project marks two years with biogas use and shore power progress

Turku-Stockholm route partnership reports tenfold increase in renewable biogas use and advancing electrification infrastructure. |

|

|

|

||

|

Global Fuel Supply unveils Blue Alliance tanker after Dubai upgrade works

Marine fuel supplier completes intermediate survey and technical upgrades on vessel ahead of operational service. |

|

|

|

||

|

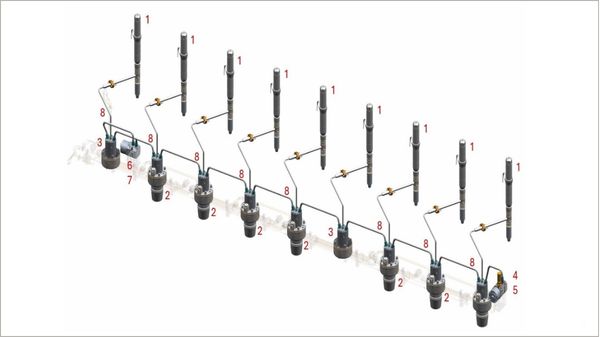

Everllence common-rail technology surpasses 20 million operating hours

Engine maker’s common-rail systems reach milestone across 600 engines and 5,500 cylinders over 18 years. |

|

|

|

||

| Study warns against 'one-sided focus on LNG' as biofuel tops CO2 reduction chart [News & Insights] |

| Zero-emission vessel study to be released in December [News & Insights] |

| Research lays out approach to assessing climate transition risk of shipping assets [News & Insights] |

| Presentation of 2020 fuel availability study at MEPC 70 [News & Insights] |

| Task force launched to decarbonize shipping with 'urgency' [News & Insights] |